The Growth of E-Commerce in the US Market: Outlook for Business Leaders

Introduction: E-Commerce as the New Core of the US Economy

By 2026, e-commerce is no longer a side channel or an experimental innovation in the United States; it has become a central pillar of the national economy and a defining force in how American consumers live, work, and spend. For readers of usa-update.com, whose interests span the economy, finance, jobs, technology, regulation, and consumer trends, the rise of digital commerce is not just a retail story but a structural transformation that touches every major sector and region, from traditional Main Street businesses in the Midwest to high-growth technology hubs on the coasts and cross-border trade routes linking North America to global markets.

The evolution of online retail and digital services has accelerated through advances in logistics, payments, data analytics, artificial intelligence, and mobile connectivity, while also being shaped by regulatory shifts, consumer protection rules, and ongoing debates about competition and market power. The United States continues to lead much of this transformation, yet it does so within an intensely competitive global landscape that includes China, the European Union, and fast-growing digital economies in Southeast Asia and Latin America. As business leaders and investors scan the horizon, understanding the dynamics of e-commerce growth in the US market has become essential for strategic planning, capital allocation, workforce development, and risk management.

For usa-update.com, which tracks developments across the economy, business, technology, jobs, finance, and consumer markets, the growth of e-commerce provides a unifying lens through which to interpret broader structural changes. It affects employment patterns, reshapes commercial real estate, influences energy consumption through data centers and logistics networks, and redefines how US companies compete internationally. This article examines the drivers, challenges, and strategic implications of e-commerce growth in the United States as of 2026, with a focus on experience, expertise, authoritativeness, and trustworthiness that business readers require for informed decision-making.

The Evolution of US E-Commerce: From Early Adoption to Digital Maturity

The story of e-commerce in the United States is often summarized through the rise of technology giants such as Amazon, eBay, and Walmart, but the deeper narrative is one of infrastructure, trust, and behavioral change. In the late 1990s and early 2000s, online shopping was driven primarily by early adopters comfortable with desktop computers and willing to experiment with new payment methods. Over the past two decades, several key developments have moved the market from experimentation to digital maturity.

The widespread adoption of broadband and mobile internet laid the foundation for always-on shopping, enabling consumers to compare prices and products in real time. The proliferation of smartphones, catalyzed by Apple's iPhone and competing devices built on Google's Android ecosystem, turned e-commerce into a truly ubiquitous activity, as consumers could browse, order, and pay from virtually any location. As digital infrastructure became more robust, logistics capabilities also expanded; national carriers and specialized fulfillment networks reduced delivery times and increased reliability, making online purchases feel less risky and more convenient than traditional shopping in many categories.

Trust mechanisms played a critical role in this evolution. The expansion of secure payment protocols, the growth of intermediaries like PayPal, and advances in fraud detection gave consumers confidence to transact online. At the same time, platforms integrated user reviews and ratings, which allowed social proof to substitute for in-person inspection and word-of-mouth recommendations. Over time, consumers came to see e-commerce not as a novelty but as a default option, especially for standardized products, digital goods, and services such as travel bookings, streaming entertainment, and software subscriptions. Business leaders seeking to understand these long-term shifts can explore broader digitalization trends through resources such as the U.S. Census Bureau's analysis of retail e-commerce and related indicators, as well as digital economy overviews from organizations like the World Bank, which place US developments within a global context.

For usa-update.com readers, this historical perspective is more than academic; it explains why certain sectors, such as books, electronics, and travel, moved online earlier, while others, including groceries, healthcare, and automotive, have seen more gradual but now accelerating digital penetration. It also clarifies why the US market, with its large consumer base, high internet penetration, and integrated logistics systems, has become a benchmark for other regions, from Europe to Asia-Pacific, that look to American models when shaping their own e-commerce strategies.

The 2026 Landscape: Scale, Segments, and Structural Shifts

By 2026, e-commerce in the United States has reached a level of scale that makes it inseparable from the broader economy. Online sales account for a substantial share of total retail, with particularly high penetration in categories such as electronics, fashion, home goods, and entertainment, while groceries, pharmaceuticals, and automotive parts continue to gain ground. The distinction between "online" and "offline" has blurred, as omnichannel models integrate digital storefronts, physical locations, and hybrid services such as buy-online-pick-up-in-store, curbside delivery, and same-day fulfillment from local warehouses.

Major players such as Amazon, Walmart, Target, Costco, and Best Buy have invested heavily in digital platforms, data analytics, and logistics networks, while specialized e-commerce companies in sectors like fashion, beauty, and home improvement compete through niche offerings, curated experiences, and brand-driven communities. At the same time, platforms such as Shopify, BigCommerce, and WooCommerce have enabled millions of small and medium-sized enterprises to build their own online stores, creating a long tail of merchants that collectively represent a significant share of digital commerce activity in the US.

The rise of marketplace models has also reshaped the competitive landscape. Large platforms host third-party sellers from across the United States and abroad, including China, Europe, and Canada, enabling cross-border trade and exposing US consumers to a wider range of products at varying price points and quality levels. This has raised complex questions about product safety, taxation, and fairness in competition, which US regulators and policymakers continue to address through evolving rules and enforcement strategies. For readers tracking regulatory developments, resources such as the Federal Trade Commission and U.S. Department of Commerce provide valuable updates on consumer protection, competition policy, and trade rules affecting digital markets.

Within this environment, usa-update.com serves as a bridge between macro-level developments and practical business implications, helping executives, entrepreneurs, and investors interpret how shifts in consumer behavior, technology adoption, and regulatory frameworks affect their specific sectors. Whether monitoring trends in the national economy, following business strategy news, or examining international trade dynamics, readers encounter e-commerce as a recurring theme that influences everything from supply chain design to capital markets.

Consumer Behavior: Convenience, Personalization, and Trust

The growth of e-commerce in the US market has been driven fundamentally by changes in consumer expectations and behavior. American consumers in 2026 expect convenience as a baseline: rapid delivery, frictionless returns, transparent pricing, and seamless checkout experiences across devices. They are accustomed to personalized recommendations, dynamic pricing, and curated content, shaped by sophisticated data analytics and machine learning algorithms that anticipate needs and preferences.

This expectation of personalization has raised the bar for all participants in the market. Large retailers rely on advanced customer data platforms and AI-driven tools to segment audiences, optimize product assortments, and tailor marketing messages. Smaller businesses, meanwhile, increasingly leverage accessible tools from providers like Mailchimp, Klaviyo, or built-in capabilities of platforms such as Shopify to deliver targeted campaigns and loyalty programs. For executives seeking deeper understanding of consumer psychology and digital behavior, research from organizations like McKinsey & Company and the Pew Research Center offers valuable insights into how Americans interact with digital channels, how trust is earned and lost, and how demographic segments differ in their online habits.

Trust remains a central factor in consumer decision-making. Data breaches, identity theft, and high-profile cybersecurity incidents have made Americans more aware of privacy and security risks, prompting many to scrutinize how companies handle personal data and what safeguards they put in place. Regulatory frameworks such as state-level privacy laws and sector-specific regulations have increased the compliance burden on businesses but also created clearer expectations for consumers. Companies that communicate transparently about data use, invest in robust security practices, and respond quickly to incidents are better positioned to maintain customer loyalty in a competitive marketplace.

At the same time, consumers have become more discerning about product authenticity, sustainability, and ethical sourcing. The rise of counterfeit goods and misleading product descriptions on some marketplace platforms has heightened concerns, leading many shoppers to favor trusted brands, verified sellers, and platforms with strong quality controls. Business leaders monitoring these shifts can explore broader trends in consumer trust and product safety through organizations like Consumer Reports and regulatory bodies such as the U.S. Food and Drug Administration and the Consumer Product Safety Commission, which regularly address issues related to online marketplaces and cross-border e-commerce.

For usa-update.com readers interested in consumer and lifestyle trends, the evolution of trust in digital commerce is particularly relevant. It influences how brands communicate, how they design customer experiences, and how they navigate reputational risks in a world where social media can amplify both praise and criticism in real time. The site's coverage of consumer dynamics and lifestyle shifts provides context for understanding how e-commerce is woven into everyday American life, from grocery delivery and telehealth to digital entertainment and remote work tools.

Evolution of US E-Commerce: 2000-2026

Technology and Infrastructure: The Digital Backbone of US E-Commerce

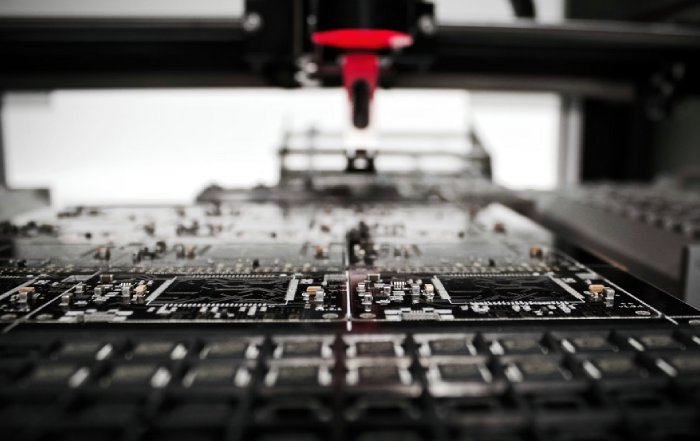

The expansion of e-commerce in the United States has been enabled by a complex technological and logistical infrastructure that continues to evolve rapidly. Cloud computing, high-speed networks, data centers, and edge computing capabilities provide the computational power and connectivity needed to support millions of daily transactions, personalized experiences, and real-time inventory management. Major providers such as Amazon Web Services, Microsoft Azure, and Google Cloud supply scalable infrastructure to both large enterprises and smaller merchants, enabling them to deploy sophisticated e-commerce solutions without building and maintaining their own data centers.

Artificial intelligence and machine learning have become integral to many aspects of digital commerce, from product recommendations and search optimization to demand forecasting and fraud detection. Companies rely on AI to analyze vast amounts of data, identify patterns, and make real-time decisions that improve customer experience and operational efficiency. For business leaders seeking to deepen their understanding of these technologies, resources such as MIT Sloan Management Review and the Harvard Business Review provide accessible analysis of AI applications in retail, logistics, and customer engagement.

On the physical side, logistics and fulfillment networks have undergone significant transformation. Advanced warehouse automation, robotics, and inventory management systems enable faster and more accurate order processing, while route optimization algorithms and last-mile delivery innovations reduce costs and delivery times. The rise of micro-fulfillment centers and urban distribution hubs allows retailers to position inventory closer to consumers, supporting same-day and even one-hour delivery in many metropolitan areas. Companies like FedEx, UPS, and DHL, along with newer last-mile providers and gig-economy delivery platforms, have adapted their business models to the demands of e-commerce, investing in technology and infrastructure that support flexible, high-volume operations.

The energy demands of this digital infrastructure are also significant, raising questions about sustainability and environmental impact. Data centers and logistics networks consume substantial amounts of electricity and fuel, prompting leading companies to invest in renewable energy, energy-efficient technologies, and carbon reduction strategies. Business leaders tracking these developments can learn more about the intersection of digital infrastructure and sustainability through organizations such as the International Energy Agency and U.S. Energy Information Administration, which analyze how digitalization affects energy consumption and climate goals. For readers of usa-update.com, these issues connect directly to the site's coverage of energy policy, corporate sustainability, and the economic implications of the energy transition.

Within this technological landscape, usa-update.com's focus on technology and business provides a platform for examining how US companies are deploying digital tools, building resilient infrastructure, and navigating the trade-offs between innovation, cost, and sustainability. The site's audience, which includes executives, entrepreneurs, and policymakers, benefits from analysis that links technical developments to strategic decisions and regulatory considerations.

Employment, Skills, and the Changing Nature of Work

E-commerce has had profound implications for employment and workforce dynamics in the United States, reshaping job categories, skill requirements, and geographic distribution of work. While some traditional retail roles have declined or transformed, new opportunities have emerged in logistics, warehousing, digital marketing, data analysis, software development, and customer service. The net impact varies by region, sector, and demographic group, making it essential for business leaders and policymakers to understand both the opportunities and the challenges.

Fulfillment centers and distribution hubs have become major employers in many regions, particularly in areas with access to transportation networks and large consumer markets. These facilities offer a range of roles, from entry-level positions in picking and packing to specialized jobs in operations management, robotics maintenance, and supply chain optimization. At the same time, the rise of gig-economy delivery platforms and flexible work arrangements has created new income streams for independent contractors, while raising questions about worker classification, benefits, and long-term career development.

On the digital side, demand for skills in software engineering, data science, cybersecurity, user experience design, and digital marketing has grown steadily, as companies across sectors seek to build and maintain competitive e-commerce capabilities. This has intensified competition for talent, particularly in major technology hubs such as San Francisco, Seattle, Austin, New York, and emerging centers across the Midwest and Southeast. Organizations such as the U.S. Bureau of Labor Statistics and World Economic Forum provide detailed analysis of employment trends and the future of work, helping business leaders anticipate skill gaps and design effective workforce strategies.

For usa-update.com readers interested in jobs and employment, the e-commerce sector offers a case study in how digital transformation can simultaneously create and displace jobs, requiring continuous learning and adaptation from workers and organizations. Companies that invest in training, upskilling, and supportive workplace cultures are better positioned to attract and retain talent in a competitive labor market, while those that neglect workforce development may struggle to keep pace with technological change.

The policy implications are equally significant. Debates over minimum wage levels, worker classification, occupational safety, and social protection have been influenced by the growth of e-commerce and the gig economy, prompting federal, state, and local governments to reconsider regulatory frameworks designed for an earlier industrial era. Business leaders must navigate this evolving landscape carefully, balancing cost, flexibility, and compliance considerations with reputational and ethical dimensions of workforce management. For those following these debates, resources such as the U.S. Department of Labor and leading policy institutes provide ongoing analysis of labor market regulation and the impact of digital platforms on employment.

Regulation, Competition, and Consumer Protection

As e-commerce has grown in scale and influence, regulatory scrutiny in the United States has intensified. Policymakers and enforcement agencies are increasingly focused on issues such as market concentration, platform power, data privacy, consumer protection, and cross-border trade. Large digital platforms that operate marketplaces, advertising networks, and cloud services have become central to these debates, as their decisions can shape entire ecosystems of merchants, suppliers, and service providers.

Antitrust and competition policy have taken on renewed significance, with regulators examining whether certain business practices hinder competition or disadvantage smaller firms. Investigations and legal actions involving major platforms such as Amazon, Google, Apple, and Meta have spurred broader discussions about how to ensure fair competition in digital markets while preserving incentives for innovation. For executives and legal teams seeking to understand these developments, resources from the U.S. Department of Justice and the Federal Trade Commission offer detailed perspectives on enforcement priorities and legal frameworks.

Data privacy and security regulations are another critical dimension. While the United States does not yet have a single comprehensive federal privacy law comparable to the European Union's General Data Protection Regulation, a patchwork of state-level laws and sector-specific rules has emerged, requiring companies to implement robust data governance, consent management, and breach notification practices. Businesses that operate across states or engage in cross-border data flows must navigate these complexities while maintaining user trust and operational efficiency. Organizations such as the International Association of Privacy Professionals provide guidance on best practices and regulatory developments, helping companies design compliant and resilient data strategies.

Consumer protection remains a core focus of US regulators, particularly in areas such as deceptive advertising, hidden fees, subscription traps, counterfeit goods, and unsafe products sold through online marketplaces. Agencies monitor both domestic and international sellers, working to ensure that consumers receive accurate information and have recourse in cases of fraud or misrepresentation. Business leaders who prioritize transparency, clear communication, and robust quality controls are better positioned to avoid regulatory risk and build long-term customer relationships. Readers of usa-update.com can explore how these regulatory trends intersect with broader regulation and news coverage, as policymakers continue to refine the rules governing digital commerce.

Internationally, trade agreements and cross-border data rules influence how US e-commerce companies operate in markets such as Canada, Mexico, Europe, Asia, and South America. Negotiations over digital trade provisions, data localization requirements, and taxation of digital services affect both large platforms and smaller exporters that rely on online channels to reach global customers. Organizations like the World Trade Organization and the Organisation for Economic Co-operation and Development provide analysis and forums for discussion on these topics, helping business leaders understand how international rules shape opportunities and risks in cross-border e-commerce.

Finance, Capital Markets, and Investor Perspectives

The growth of e-commerce has reshaped financial markets and investment strategies in the United States, influencing everything from venture capital allocations and initial public offerings to corporate mergers and acquisitions. Digital commerce companies, both pure-play and omnichannel, have attracted significant capital due to their scalability, data-driven business models, and potential for recurring revenue through subscriptions and loyalty programs. At the same time, investors have become more discerning, focusing on unit economics, customer acquisition costs, and long-term profitability rather than growth at any cost.

Public markets have seen waves of e-commerce-related listings, including online marketplaces, direct-to-consumer brands, logistics providers, and fintech companies that enable digital payments and lending. The performance of these firms has varied, with some achieving sustained growth and others facing challenges related to competition, customer retention, and operational complexity. For investors and corporate finance leaders, resources such as the U.S. Securities and Exchange Commission, major financial news outlets, and analysis from institutions like Goldman Sachs and Morgan Stanley provide detailed insights into market dynamics, valuation trends, and sector-specific risks.

Payment technologies have been a particularly dynamic area within the broader e-commerce ecosystem. The adoption of digital wallets, contactless payments, and buy-now-pay-later services has transformed how consumers pay for goods and services online and in physical stores. Companies such as PayPal, Stripe, Square (Block), and major card networks have developed new products and partnerships to capture these opportunities, while banks and traditional financial institutions have adapted their offerings to remain competitive. For those interested in understanding how these financial innovations intersect with e-commerce, organizations like the Federal Reserve and Bank for International Settlements provide valuable analysis of payment systems, digital currencies, and financial stability considerations.

Readers of usa-update.com who follow finance and economy coverage will recognize that e-commerce is intertwined with broader trends in consumer credit, household spending, and business investment. The ability of US households to access credit, manage debt, and maintain confidence in economic prospects directly influences online spending patterns, while corporate investment in digital infrastructure and logistics shapes the capacity of the system to handle continued growth. Understanding these interdependencies is essential for executives making strategic decisions about expansion, diversification, and risk management.

Global Context: How the US Compares and Competes

While the United States remains a global leader in e-commerce innovation, it operates within a highly competitive international environment. China has developed its own powerful ecosystem of digital platforms, including Alibaba, JD.com, and Pinduoduo, along with super-apps such as WeChat that integrate payments, messaging, and commerce. In Europe, regulatory frameworks emphasize privacy, competition, and consumer protection, shaping how both domestic and international platforms operate. Emerging markets in Southeast Asia, Latin America, and Africa have seen rapid digital adoption, often leapfrogging traditional retail infrastructure and mobile payments.

For US businesses, this global context presents both opportunities and challenges. On one hand, American companies can leverage their technological capabilities, brand recognition, and capital access to expand into international markets, tapping into growing middle-class populations and rising internet penetration. On the other hand, they must adapt to local regulations, cultural preferences, and competitive landscapes that differ significantly from the US environment. Organizations such as the International Monetary Fund and World Bank provide macroeconomic and digitalization data that help executives assess which regions offer the most promising growth prospects and what risks must be managed.

Cross-border e-commerce also raises operational and regulatory complexities, including customs procedures, taxation, data transfer rules, and consumer protection standards. US companies that engage in international sales must design strategies that account for these factors while maintaining consistent brand experiences and service levels. For readers of usa-update.com, the site's international coverage connects these global dynamics back to US policy debates, trade relations, and corporate strategies, helping business leaders understand how international developments feed into domestic economic performance and regulatory choices.

Travel, Lifestyle, and the Blurred Boundaries of Digital and Physical

The growth of e-commerce has also transformed sectors that might initially appear unrelated to online retail, such as travel, entertainment, and lifestyle services. Online travel agencies, airline and hotel booking platforms, and short-term rental marketplaces have long been part of the digital economy, but their integration with broader e-commerce ecosystems has deepened. Consumers increasingly expect unified digital experiences that connect travel planning, accommodation, local services, and entertainment, often through mobile apps and personalized recommendations.

Streaming platforms, gaming services, and digital content providers have become central to American entertainment consumption, competing not only with traditional media but also with physical leisure activities. Subscription models and microtransactions have created new revenue streams, while raising questions about consumer spending patterns and digital well-being. Organizations such as Nielsen and the Motion Picture Association provide data and analysis on media consumption and entertainment trends, highlighting the extent to which digital platforms now shape American culture and leisure time.

For usa-update.com, which covers entertainment, travel, and lifestyle trends, the convergence of digital and physical experiences is a recurring theme. The way Americans plan vacations, attend events, discover local experiences, and consume media is increasingly mediated by digital platforms that collect data, personalize offerings, and facilitate transactions. This has implications not only for consumer behavior but also for local economies, tourism strategies, and urban planning, as cities and regions adapt to changing patterns of visitor flows and spending.

The blending of digital and physical also extends to retail environments themselves. Many brands have adopted experiential store formats, pop-up locations, and showrooms that serve as extensions of their online presence, offering immersive experiences rather than traditional inventory-heavy layouts. These hybrid models reflect a recognition that consumers value both convenience and sensory engagement, and that successful strategies must integrate online and offline touchpoints seamlessly.

Strategic Implications for US Businesses in 2026

For business leaders in the United States, the growth of e-commerce in 2026 presents a complex mix of opportunities and risks that require thoughtful, data-driven strategies. Companies that treat digital channels as peripheral or experimental risk falling behind competitors that integrate e-commerce into their core business models, supply chains, and customer engagement strategies. At the same time, rapid digital expansion without attention to fundamentals such as profitability, customer lifetime value, and operational resilience can lead to overextension and vulnerability in volatile markets.

Strategically, organizations must decide how to position themselves within the e-commerce ecosystem. Some will operate their own branded platforms, investing in technology, logistics, and marketing to build direct relationships with customers. Others will rely on large marketplaces and third-party platforms to reach broader audiences, accepting some loss of control over customer data and experience in exchange for scale and convenience. Many will adopt hybrid approaches, balancing direct and marketplace channels, experimenting with subscription models, and exploring partnerships that extend their reach and capabilities.

Data strategy is central to these decisions. Companies that effectively collect, analyze, and act on customer and operational data can optimize pricing, inventory, marketing, and service, while also meeting regulatory requirements and ethical expectations around privacy and security. Those that lack robust data capabilities may struggle to compete on personalization, efficiency, and innovation. For executives seeking guidance on data-driven strategy, analysis from institutions such as Deloitte, Accenture, and Gartner offers frameworks and case studies that illustrate best practices and common pitfalls.

Risk management is equally important. Cybersecurity threats, supply chain disruptions, regulatory changes, and reputational risks can all impact e-commerce operations and brand equity. Companies must invest in resilient infrastructure, contingency planning, and transparent communication strategies to navigate these challenges. They must also monitor macroeconomic conditions, as shifts in interest rates, inflation, and consumer confidence can influence online spending patterns and capital availability. Readers of usa-update.com can follow these broader economy and news trends to contextualize their e-commerce strategies within the wider business environment.

For US businesses operating in or expanding into international markets, strategic considerations include localization of content and offerings, compliance with local regulations, and partnerships with regional platforms and logistics providers. Understanding cultural nuances, payment preferences, and trust factors in markets such as Europe, Asia, South America, and Africa is critical to building sustainable cross-border e-commerce operations.

Conclusion: E-Commerce as a Long-Term Structural Force

As of 2026, e-commerce in the United States has moved far beyond the realm of retail disruption and into the core of economic and business strategy. It influences how companies design products, interact with customers, structure supply chains, manage finances, and engage with regulators and policymakers. It shapes employment patterns, energy consumption, urban development, and international trade. For the audience of usa-update.com, which spans sectors from finance and technology to employment, consumer markets, and international affairs, e-commerce is a lens through which many of the most important trends of the decade can be understood.

The growth of digital commerce is not a temporary surge but a long-term structural shift that continues to evolve as technology advances, consumer expectations change, and regulatory frameworks adapt. Companies that embrace this reality with clear strategies, strong execution, and a commitment to trust and transparency will be well positioned to thrive in the years ahead. Those that underestimate the depth and breadth of the transformation may find themselves struggling to catch up in a marketplace where digital competence and customer-centricity are no longer differentiators but basic requirements.

In this environment, platforms like usa-update.com play a critical role by providing timely, authoritative analysis that connects developments across the economy, business, technology, jobs, finance, regulation, and consumer landscapes. As e-commerce continues to reshape the US market and its global connections, informed, data-driven perspectives will be essential for leaders who must navigate uncertainty while positioning their organizations for sustainable growth in a digitally driven future.