The United States Energy Market: Competition, Transition, and Global Influence

A New Phase for the US Energy Landscape

By 2026, the United States energy market has moved beyond the early transition rhetoric of the 2020s into a more complex and competitive phase in which the balance between fossil fuels, renewables, and digital technologies is being tested in real time. For the audience of usa-update.com, this evolution is not an abstract policy discussion; it is reshaping the cost of living, the structure of the labor market, the direction of capital flows, and the country's strategic position in a volatile world. The United States still benefits from its legacy of abundant oil and natural gas resources, but the competitive landscape has changed dramatically as China, the European Union, and a range of emerging economies have accelerated their own energy transitions and bid aggressively for leadership in clean technology and critical materials.

Energy has become a central organizing principle of economic planning, trade strategy, and domestic politics. The decisions taken in Washington, in state capitals, and in corporate boardrooms now influence not only whether the United States can retain its status as a leading exporter of energy and energy technologies, but also whether it can maintain influence over global standards, rules, and climate commitments. Readers following developments on USA Update's economy coverage see clearly that the energy system is now directly linked to inflation trends, industrial policy, and the competitiveness of US manufacturing against European and Asian rivals.

From Fossil Dominance to Integrated Energy Systems

The evolution of the US energy market over the last decade is best understood as a shift from a fossil-dominated system to an integrated, multi-source ecosystem that combines oil, gas, renewables, nuclear, and emerging low-carbon fuels. The shale revolution of the 2010s transformed the United States into a top producer of oil and natural gas, enabling it to become a major exporter and reshaping global geopolitics. By the mid-2020s, however, the policy and market environment has forced a deeper reconfiguration in which renewables, energy storage, and efficiency are no longer peripheral, but central pillars of planning.

Solar and wind power now account for a substantial and steadily rising share of US electricity generation, complemented by hydropower, geothermal projects, and a renewed interest in nuclear energy, particularly advanced reactors and small modular reactors. The US Department of Energy has continued to emphasize grid modernization and resilience, with smart meters, distributed energy resources, and AI-driven control systems becoming embedded in utility operations. At the same time, oil and gas retain a dominant role in transportation, petrochemicals, and heavy industry, which means the United States operates a dual-track system: decarbonizing electricity and parts of industry while still relying heavily on fossil fuels for mobility and industrial feedstocks.

This mixed structure creates both opportunity and risk. It allows the United States to leverage its traditional strengths while pivoting toward cleaner technologies, but it also exposes the economy to the volatility of global oil and gas markets and the uncertainties of scaling renewables and storage fast enough to meet climate commitments. Readers tracking US energy and business developments recognize that this hybrid model demands sophisticated strategy from both policymakers and corporate leaders.

Regulation, Industrial Policy, and the New Rules of Competition

Regulation and industrial policy have become primary tools in shaping the trajectory of the US energy system. Federal tax credits for wind, solar, energy storage, and electric vehicles, combined with support for green hydrogen, grid upgrades, and domestic manufacturing of clean technologies, have created a powerful incentive framework for investors. The extension and refinement of these incentives into the late 2020s have helped de-risk large-scale renewable and storage projects, while also encouraging the build-out of charging infrastructure and low-carbon industrial hubs.

At the same time, environmental and emissions regulations on fossil fuels have tightened. Power plant standards, methane regulations for oil and gas operations, and state-level climate targets, particularly in states such as California, New York, and Washington, are pushing incumbents to decarbonize or risk losing market share. Other states, including Texas, Louisiana, and North Dakota, continue to champion fossil fuel production and downstream refining and petrochemical investment, creating a patchwork of regulatory regimes that companies must navigate carefully. Businesses monitoring policy shifts through resources like USA Update's regulation coverage understand that regulatory risk is now as central to energy strategy as resource risk.

This policy environment is also deeply intertwined with industrial strategy. The United States has moved closer to the European model of using public incentives to foster domestic manufacturing in strategic sectors such as batteries, solar modules, and grid equipment. While still more market-driven than many European and Asian counterparts, US policy in 2026 is more explicit about linking energy transition goals to jobs, supply chain resilience, and technological sovereignty. This has important implications for trade relations with Europe, Canada, Mexico, and Asia, where competing industrial policies are increasingly framed as both climate action and economic security.

Corporate Powerhouses and New Entrants

The corporate landscape of US energy in 2026 reflects both continuity and disruption. Traditional oil and gas majors such as ExxonMobil, Chevron, and ConocoPhillips remain major actors, leveraging strong balance sheets and global portfolios. These companies are investing in carbon capture and storage, low-carbon fuels, and methane abatement, not only to meet regulatory requirements but also to preserve their license to operate in a more climate-conscious world. However, their core profitability still depends heavily on upstream oil and gas, and investors carefully scrutinize whether their transition strategies are credible and aligned with long-term climate objectives.

On the power and renewables side, companies including NextEra Energy, Duke Energy, Southern Company, and Dominion Energy have emerged as central players in scaling wind, solar, and storage, while managing the complexities of retiring coal plants, modernizing transmission networks, and integrating distributed resources. Independent power producers and renewable specialists such as First Solar and a growing cluster of battery manufacturers, grid software firms, and energy services companies are reshaping competition in generation and customer-facing services.

Technology companies have also deepened their role. Tesla and its energy division, along with other innovators in electric vehicles and stationary storage, have become integral to the broader energy ecosystem. Cloud and AI providers such as Google, Microsoft, and Amazon Web Services offer grid optimization, demand forecasting, and data analytics services to utilities and industrial users. This convergence of energy and digital technology is a defining feature of 2026, and readers following technology and energy coverage can see that the traditional boundaries between sectors are dissolving.

Europe's Coordinated Ambition and Competitive Pressure

The European Union continues to present one of the strongest competitive challenges to US energy leadership, not primarily through natural resource endowment, but through policy coordination, regulatory sophistication, and technological deployment. The European Green Deal, its climate law, and the strengthening of the EU Emissions Trading System have collectively driven a structural shift toward renewables, energy efficiency, and electrification across member states. Countries such as Germany, Denmark, Spain, and Netherlands are leaders in offshore wind, onshore wind, and solar deployment, while France retains a significant nuclear fleet and is exploring advanced reactor designs.

European energy companies including Siemens Energy, Vestas, Iberdrola, Ørsted, and Enel have become global reference points in wind, grid integration, and renewable project development. The EU's focus on cross-border interconnections and integrated energy markets has built a system that can share surplus renewable generation, manage variability, and coordinate investment at scale. For US firms, the European market offers both partnership opportunities and formidable competitors who bring experience in complex regulatory environments and large-scale renewable integration. Readers interested in how European developments influence US markets can explore broader context in international coverage at USA Update's international section.

Europe has also moved ahead in some aspects of green industrial policy, including carbon border adjustment mechanisms and stricter product standards that effectively export EU rules to trading partners. For US manufacturers of energy-intensive goods, these measures raise the stakes for decarbonization and could reshape trade flows between North America and Europe over the coming decade.

🔋 US Energy Market Evolution Timeline

China's Scale Advantage and Strategic Leverage

While Europe leads in regulatory innovation, China dominates the global energy transition through scale, industrial capacity, and control of critical supply chains. By 2026, Chinese firms remain world leaders in the production of solar modules, lithium-ion batteries, and many components essential to wind turbines and grid equipment. Companies such as Contemporary Amperex Technology Limited (CATL) and BYD are major suppliers of batteries and electric vehicles, while LONGi Green Energy and other manufacturers control a significant share of global solar panel output. China's upstream position in processing critical minerals such as lithium, cobalt, and rare earth elements gives it substantial leverage in setting prices and influencing availability for global manufacturers.

China's domestic energy strategy combines rapid expansion of renewables with continued reliance on coal for baseload power and energy security, alongside growing investment in ultra-high-voltage transmission, nuclear, and green hydrogen pilots. This duality enables Beijing to support its industrial machine while presenting itself as a key partner for developing countries seeking affordable clean energy technologies. For the United States, this creates a strategic dilemma: Chinese supply chains remain cost-competitive and deeply embedded in global trade, yet dependence on them raises national security and economic resilience concerns.

US policymakers have responded by promoting domestic manufacturing, incentivizing battery and solar production, and seeking to diversify mineral supply from partners such as Australia, Canada, Chile, and Brazil. Trade tensions, export controls, and investment screening now intersect with energy and climate policy, making the landscape more complex for businesses planning long-term investments. Readers can follow how these international dynamics affect American industries through USA Update's international business coverage.

The Middle East, OPEC+, and the Persistent Power of Oil

Despite the rapid growth of renewables, the global economy in 2026 still relies heavily on oil and gas, and the Middle East remains central to these markets. Saudi Arabia, United Arab Emirates, Qatar, and other OPEC+ members continue to exert significant influence over global oil prices through production decisions, while expanding liquefied natural gas capacity and petrochemical investments. Companies such as Saudi Aramco, QatarEnergy, and ADNOC are deploying capital into both traditional hydrocarbons and lower-carbon initiatives including carbon capture, blue and green hydrogen, and renewable projects.

For the United States, which has become a major exporter of both crude oil and LNG, the Middle East is no longer the dominant supplier it once was, but it remains a key determinant of global price stability and a critical partner in energy diplomacy. US energy independence in physical terms does not equate to insulation from global price shocks, as American consumers still feel the impact of OPEC+ decisions at the gas pump and in broader inflation trends. Investors and executives who follow USA Update's business and finance coverage understand that Middle Eastern production strategies, regional tensions, and shipping security in chokepoints such as the Strait of Hormuz remain vital variables in any energy market forecast.

North American Integration: Canada, Mexico, and Regional Strategy

The North American energy system has grown more interdependent, with Canada and Mexico playing crucial roles in supply, trade, and investment. Canada's hydroelectric resources, oil sands, conventional oil and gas, and growing wind and solar capacity make it both a supplier and a collaborator in low-carbon projects. Cross-border electricity trade, particularly from Canadian hydropower into US states in the Northeast and Midwest, supports decarbonization goals and grid reliability. Canada is also positioning itself as a key supplier of critical minerals and a leader in hydrogen, aligning with the United States on supply chain resilience and clean fuel exports.

Mexico, for its part, has a complex energy landscape shaped by constitutional reforms, debates over state versus private control, and growing potential in solar and wind resources, especially in northern and central regions. Cross-border natural gas pipelines and electricity interconnections tie Mexico's energy system to that of the United States, and discussions about regional clean energy corridors and manufacturing hubs are increasingly prominent in the context of the US-Mexico-Canada Agreement (USMCA). For readers focused on North American dynamics, USA Update's international section provides a broader lens on how trilateral cooperation and friction shape energy investment and trade.

Asia-Pacific: Rapid Innovation and Expanding Demand

Beyond China, the Asia-Pacific region is a focal point for both energy demand growth and technological innovation. Japan continues to pursue a diversified strategy that includes offshore wind, hydrogen imports, and a cautious revival of nuclear power after the Fukushima crisis, while also investing in energy efficiency and grid modernization. South Korea is developing a comprehensive hydrogen ecosystem spanning production, transportation, and end-use in transport and industry, and its conglomerates are significant players in global battery and shipbuilding markets. Singapore is cementing its role as a regional energy trading and innovation hub, leveraging digital infrastructure and regulatory agility to pilot smart grid, demand response, and carbon services.

These developments create both competition and opportunity for US firms. The region's growing demand for LNG has supported US export projects on the Gulf Coast, while partnerships in clean technology, digital platforms, and advanced materials are expanding. At the same time, Asian manufacturers compete aggressively with US and European companies in batteries, solar, and electric vehicles. Businesses tracking technology and global energy trends understand that Asia-Pacific is simultaneously a market, a supplier base, and a strategic competitor.

Emerging Markets: Africa, South America, and Strategic Resources

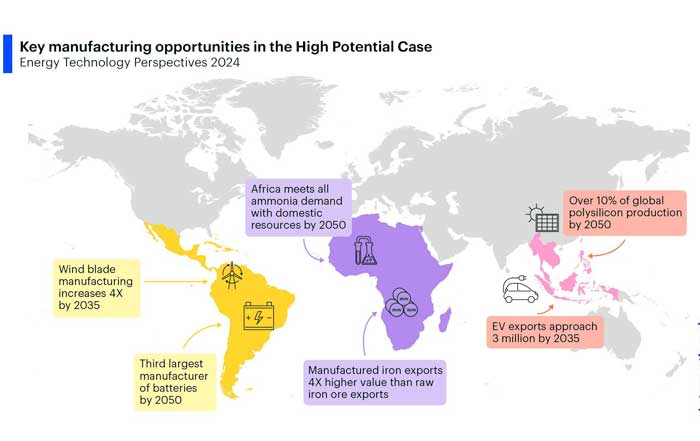

Africa and South America are increasingly central to the global energy conversation, not only as sites of growing demand but also as sources of critical materials and renewable potential. In Africa, countries such as South Africa, Morocco, Kenya, and Egypt are scaling solar, wind, and geothermal resources, often with support from multilateral institutions and foreign investors. Large-scale projects like Morocco's Noor Solar Complex have demonstrated that emerging economies can deploy world-class renewable infrastructure, creating new benchmarks for cost and scale.

South America, particularly Brazil, Chile, Argentina, and Colombia, combines conventional oil and gas resources with hydropower, biofuels, and some of the world's most important lithium deposits. Brazil remains a leader in bioethanol and biodiesel, while Chile and Argentina play key roles in lithium extraction, essential for batteries and storage. For the United States, building stable partnerships with these countries is central to diversifying away from Chinese-dominated supply chains for energy transition minerals and technologies. Readers interested in trade and investment opportunities can follow related developments in USA Update's business coverage.

Finance, ESG, and the Reallocation of Capital

Financial markets have become a powerful driver of the energy transition, both in the United States and globally. Large asset managers such as BlackRock, Vanguard, and State Street, along with banks including JPMorgan Chase, Goldman Sachs, and Bank of America, have embedded environmental, social, and governance (ESG) considerations into risk assessments and lending policies, even as political debates over ESG intensify domestically. Green bonds, sustainability-linked loans, and climate-focused investment funds are channeling capital into renewables, grid infrastructure, storage, and low-carbon industrial projects.

At the same time, fossil fuel investments have not disappeared; instead, they are increasingly concentrated in companies and projects that can demonstrate strong financial returns, robust risk management, and credible decarbonization plans. Sovereign wealth funds in Norway, Saudi Arabia, United Arab Emirates, and Singapore are diversifying into renewables, infrastructure, and technology, reinforcing the global trend toward cleaner portfolios. For professionals tracking energy finance, USA Update's finance section underscores how capital allocation decisions are reshaping which technologies and business models scale rapidly and which struggle to attract funding.

Employment, Skills, and Workforce Realignment

The energy transition has profound implications for jobs and skills, both in the United States and abroad. While some traditional roles in coal mining and certain segments of oil and gas face decline or transformation, new opportunities are emerging in solar and wind installation, battery manufacturing, grid modernization, hydrogen infrastructure, and digital energy services. The US Bureau of Labor Statistics projects continued growth in occupations related to renewable energy and energy efficiency, and state and local governments are increasingly tying training programs and community benefits agreements to new projects.

However, the shift is uneven. Regions heavily dependent on fossil fuel extraction and refining confront difficult adjustments, requiring targeted policies for retraining, economic diversification, and social support. Meanwhile, high-tech roles in data analytics, cybersecurity, AI-driven grid management, and advanced engineering demand new educational pathways and collaboration between industry and universities. Readers seeking to understand where the next wave of energy jobs will emerge can explore relevant insights through USA Update's employment coverage and jobs-focused reporting, which track how federal and state programs, corporate strategies, and global competition shape the labor market.

Technology, AI, and the Smart Energy Ecosystem

Digital technologies are now woven into nearly every layer of the US energy system. Artificial intelligence, machine learning, and advanced analytics are optimizing power plant operations, predicting equipment failures, and managing demand response at scale. Utilities and grid operators use AI to balance variable renewable generation with storage and flexible loads, while industrial companies deploy digital twins and IoT sensors to improve energy efficiency and reduce emissions. Technology leaders such as Google, Microsoft, and Amazon are not only large energy consumers, particularly through data centers, but also providers of software and cloud services that underpin next-generation grid management.

Smart meters and home energy management systems give consumers greater insight and control over their consumption, and in some states, households with rooftop solar and batteries can participate in virtual power plants, providing grid services and earning revenue. However, the increasing digitalization of energy systems brings new cybersecurity risks. Critical infrastructure is a target for sophisticated cyberattacks, and both the US Department of Energy and the Department of Homeland Security have elevated cyber resilience as a strategic priority. Readers following technology developments in energy can see how the interplay between innovation and security is shaping long-term planning.

Consumer Experience, Affordability, and Lifestyle

For American households and businesses, the energy transition is experienced most directly through prices, reliability, and the availability of new technologies. Electricity bills reflect not only fuel and infrastructure costs but also the investments required to modernize the grid and integrate renewables. While the levelized cost of solar and wind has fallen dramatically over the past decade, the upfront costs of rooftop systems, home batteries, and electric vehicles remain significant for many families, even with federal and state incentives.

Regional disparities persist. States with aggressive renewable deployment and strong policy support often see faster adoption of electric vehicles, heat pumps, and rooftop solar, while some rural and fossil-dependent regions face higher transition costs and slower infrastructure upgrades. Community solar programs, on-bill financing, and leasing models are helping broaden access, but affordability and equity remain central policy concerns. At the same time, energy choices have become part of lifestyle and identity, as consumers embrace efficient appliances, smart thermostats, and EVs as expressions of environmental values and modern living. Readers interested in how these trends affect daily life and purchasing decisions can explore USA Update's consumer coverage and lifestyle reporting.

Energy Security, Geopolitics, and Defense

Energy security has taken on a more multidimensional character in 2026. Traditional concerns about dependence on imported oil have been partially alleviated by US production and diversification of supply, but new vulnerabilities have emerged around critical minerals, advanced components, and cyber risks. Tensions with Russia, ongoing competition with China, and instability in parts of the Middle East and Africa all have implications for supply chains, shipping routes, and commodity prices. The war in Ukraine and its aftermath have reshaped European gas markets and increased demand for US LNG, linking American export capacity more directly to European energy security.

For the US Department of Defense, energy resilience is a strategic imperative. Military bases are investing in microgrids, on-site renewables, and advanced storage to reduce dependence on vulnerable fuel supply lines and external grids. Internationally, energy cooperation and competition intersect with broader diplomatic agendas in forums such as the United Nations, G7, and G20, where climate and energy security are now permanent fixtures on the agenda. Readers can follow the intersection of energy and geopolitics through USA Update's international news, which highlights how diplomatic developments feed back into markets and corporate strategies.

Travel, Transport, and Global Supply Chains

The transport sector remains one of the most challenging frontiers for decarbonization. Road transport is undergoing rapid electrification, with major automakers in the United States, Europe, Japan, and South Korea scaling EV production, but aviation, shipping, and heavy-duty trucking still rely heavily on liquid fuels. Airlines such as Delta Air Lines, United Airlines, and American Airlines are increasing their use of sustainable aviation fuel, yet volumes remain modest relative to total jet fuel demand, and costs are high. Shipping companies like Maersk and CMA CGM are piloting vessels powered by green methanol, ammonia, and LNG, but global fleets remain dominated by conventional fuels.

For the United States, the energy profile of transport has direct implications for travel costs, trade competitiveness, and logistics resilience. Port decarbonization, rail electrification, and the rollout of hydrogen and battery-electric trucks are all part of a broader strategy to align supply chains with climate goals. Travelers and businesses concerned with these dynamics can find broader context in USA Update's travel coverage, which connects energy prices and technology trends to mobility and tourism.

Events, Media, and Public Perception

International conferences and high-profile events continue to shape the narrative and direction of the energy transition. The annual United Nations Climate Change Conferences (COP), along with gatherings such as the World Economic Forum and regional energy summits, provide platforms where governments, corporations, and civil society negotiate commitments, showcase technologies, and debate the pace of change. For US companies and policymakers, these events are opportunities to demonstrate leadership, secure partnerships, and influence emerging standards on topics such as carbon markets, methane emissions, and green hydrogen certification.

Media and entertainment also play a growing role in shaping public perception. Documentaries, streaming series, and investigative reporting from outlets such as The New York Times, The Wall Street Journal, and Bloomberg have elevated public understanding of climate risks, energy technologies, and corporate accountability. Streaming platforms like Netflix and HBO have brought energy and climate narratives into mainstream culture, influencing consumer expectations and political pressure. Readers of USA Update's entertainment coverage see that energy is no longer a niche topic; it is embedded in cultural debates about the future of work, cities, and lifestyles.

Strategic Outlook to 2035: Risks, Opportunities, and Leadership

Looking ahead to 2035, the United States faces a decisive decade in which its choices on energy will strongly influence its economic competitiveness, social cohesion, and geopolitical influence. Forecasts suggest that renewables, supported by storage and flexible demand, will continue to gain market share, potentially overtaking natural gas in power generation if policy support and technological progress remain robust. Nuclear energy, particularly small modular reactors and advanced designs, could play a larger role if regulatory frameworks and public acceptance evolve favorably.

At the same time, global energy demand is expected to grow, driven by urbanization and rising incomes in Asia, Africa, and Latin America. This growth creates markets for US LNG, hydrogen, and advanced technologies, but it also intensifies competition from China, Europe, and regional players. Key risks include volatile fossil fuel prices, supply disruptions for critical minerals, cybersecurity threats, and political polarization that could undermine policy stability. For readers of USA Update's economy and business sections, it is clear that energy strategy is now inseparable from industrial policy, trade, and fiscal planning.

Yet the United States retains significant advantages: a deep capital market, world-class research universities and national laboratories, a strong culture of entrepreneurship, and substantial natural resources. If these strengths are harnessed through coherent policy, strategic investment, and inclusive workforce development, the country can remain a central architect of the global energy system rather than a reactive participant.

Conclusion: What the Energy Future Means for USA-Update.com Readers

For the community that turns to usa-update.com for insight into the economy, business, jobs, technology, lifestyle, and international affairs, the US energy market in 2026 is not merely a sectoral story; it is a lens through which broader national and global trends become visible. Energy prices influence household budgets and corporate margins; regulatory shifts affect investment and employment; international competition in clean technology and resources shapes trade balances and diplomatic alignments.

The United States stands at a critical juncture where its historical strengths in fossil fuel production must be reconciled with the imperatives of decarbonization, digitalization, and strategic resilience. Success will depend on sustained innovation, stable and forward-looking regulation, diversified supply chains, and a workforce equipped to thrive in a rapidly changing landscape. It will also require an informed public and business community that understands the stakes and engages with the choices ahead.

By following ongoing developments across news, business, economy, technology, energy, and related topics, readers of usa-update.com can track how this transformation unfolds and position themselves-whether as investors, professionals, consumers, or citizens-to navigate and shape the next chapter of the US and global energy story.